Tranzbase is now a unique concept of digital banking and payment, which aims to establish ideal and safe financial solutions for trade across Europe and the rest of the world. It embraces new-age financial technology solutions to provide an effective solution for both business entities and individuals to minimize their costs on banking and other related services.

What is Tranzbase?

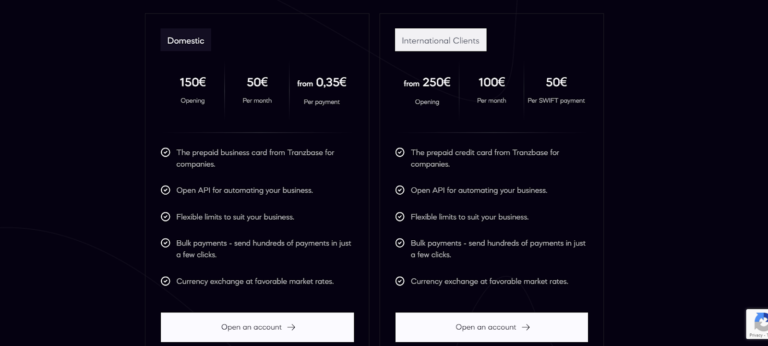

Tranzbase is a new-generation skill and system that provides excellent logistics and supply chain services. It is a single digital platform solution for business transport, freight forwarding, and logistics. Visit https://tranzbase.com now to start today! Here are the pricing options:

How to Use Tranzbase: 8 Easy Steps to Use Tranzbase

Through the enhanced features of Tranzbase, companies can ensure they align their supply chain processes, reduce their expenses, and enhance the efficiency of their deliveries.

Step 01: Create an Account

To use Tranzbase, open a web browser, go to the Tranzbase home page, and register for the software. You will be asked to fill in your name, company name, and other addresses and contact details here. After getting to the registration, you may be asked to open your mailbox and click the confirmation link from the given mail.

Step 02: Set Up Your Profile

After signing up, navigate to create your company profile and put the basic information, such as the firm’s name, location, or business category. You should also do this by setting your preferences about currency, time, and carriers or shipping partners. This setup allows Tranzbase to develop a set of services that suit the individual needs of a customer.

Step 03: Integrate with Carriers and Logistics Partners

Tranzbase has the connectivity to enable users to link up with different carriers, freight forwarders, and 3PLs. It allows you to integrate your trading relationships with these partners into Tranzbase to get actual rates, tracking, and shipping data. This integration assists in the process of combining all logistics operations under one platform and, hence, can be easily managed.

Step 04: Plan Your Shipments

Once the profile and all the links to the logistics providers are established, it is possible to start planning the shipments. Type in pick-up and drop-off addresses, as well as the type of shipment, its size, weight, and dimensions.

With Tranzbase, you will get several shipping quotes from different carriers, which will help you evaluate the cost, delivery time, or quality of the service being offered.

Step 05: Select a Carrier and Book Your Shipment

Based on the services offered and provided shipping options, the consumer should be able to select the most appropriate carrier that best suits the consumer in regard to price, delivery time, and services. You can schedule your shipment via Tranzbase, wherein all paperwork, negotiations, and other dealings will go straight to the preferred carrier.

Step 06: Track Your Shipments in Real-Time

When a shipment is booked with Tranzbase, you can track it in real-time from where it is picked up to where it is delivered. You can opt for alerts and learn about basic happenings like shipment delays, customs clearance, or delivery confirmation.

Step 07: Manage Documentation and Compliance

Tranzbase works to minimize documentation: it creates shipping labels, invoices, or any other corresponding papers needed for customs and more to fulfill regulatory requirements. This feature takes care of the paperwork, thus minimizing it and also making sure that all the papers used are updated.

Step 08: Analyze Performance and Optimize

The last three features are basic but crucial, as they will help you track your logistics efficiency, cost, and delivery times with Tranzbase’s built-in analytics and reporting. When implemented in your supply chain network analysis, these insights provide information on inefficiencies, suggest possible routes for improvement, offer better rates for negotiations, and increase overall supply chain effectiveness.

Key Features of Tranzbase | 7 Main Features

Tranzbase is a cutting-edge digital payment platform offering seven key features:

1. Multiple Payment Options

Tranzbase facilitates many payment types, such as SEPA, SWIFT, FPS, and CHAPS. It helps to make prompt and safe financial transactions using various currencies and is available in 19+ countries.

SEPA Instant payments with Tranzbase enable euro-based transactions across the EU, implying that payments will be made as soon as possible, every day of the week, and all year round. Regarding payment settlement, this feature is quite helpful to enterprises needing a fast payment workflow.

2. Secure and User-Friendly Interface

Tranzbase values its clients’ security, hence implementing strong security measures for its interface that are easy to use. For added security, the platform employs the latest encryption to safeguard the users’ information and secure the transactions.

Also, the interface is prepared to be very comfortable, and users will have no difficulty using services like opening an account remotely, transferring funds, or exchanging currency.

3. Convenience

The system enables users to open a new account online, create a new account, and access the account and international bank account numbers (IBAN) remotely. This feature is helpful for global clients who can open their accounts without actually having to visit the premises.

Onboarding of the new users is easy, and the users can begin using their account as soon as they submit their application, at most within a day.

4. Competitive Currency Exchange Rates

Tranzbase offers competitive exchange rates, thus enabling clients to get the best price in the market for exchange costs. Its FX (foreign exchange) solution supports companies in managing risks attributable to exchange rate fluctuations while seeking to enhance the speed of transaction processing.

This feature can prove very beneficial for firms involved in international business and need cheap and effective foreign exchange services.

5. Less Bank Charges

Another plus point worth mentioning in relation to using Tranzbase is that it comes with much lower charges than most banks. Compared to traditional banking institutions, Tranzbase does not require the establishment of physical branches, thus cutting its overhead expenses.

Therefore, the platform is cheaper with fewer rates, lower charges, and better exchange rates, thus helping business people and people of different callings minimize their international payment expenses.

6. Business Banking Products and Services from Tranzbase

Beyond its core business of issuing bulk payments, Tranzbase has developed a branded prepaid business card and an API that is open to other businesses. This affords convenience when handling bulk payments involving huge amounts of money, such as employee remunerations or suppliers’ statements.

Of greatest importance is that this feature is useful when a business wants to enhance efficiency in its payment operations while minimizing workload.

7. Comprehensive Support and Global Reach

Customer support is comprehensive and personalized, which is why Tranzbase boasts of it. A user contacts a proficient personal manager who is always ready to help and consult at any time.

In addition, the platform is not only limited to Europe but also has payout service within different areas, such as Switzerland and Israel. Other countries can be incorporated upon client request so that various firms can diversify their operations internationally.

Benefits of Using Tranzbase

- Speed and Efficiency: The SEPA Instant payment system implemented in Tranzbase permits the creation and execution of payment transactions in real-time, helping businesses and individuals reduce the time spent waiting to complete a transaction and, in effect, increasing their cash management efficiency.

- Cost Savings: Other benefits of Tranzbase include flexibility resulting from its being an online platform alone, which cuts costs like physical branches and offers better rates than most of its competitors.

- Security and Compliance: For instance, Tranzbase enhanced encryption technologies to offer security in completing financial transactions, and the company complies with global financial standards.

- Global Accessibility: The platforms’ coverage of SWIFT and SEPA networks accelerates cross-border transactions, expanding business operations in foreign countries.

FAQs

1. What payment methods does Tranzbase support?

Some payment options include SEPA, SWIFT, FPS, and CHAPS, which make transactions within Europe and worldwide easy and secure.

2. How secure are transactions on Tranzbase?

Nevertheless, Tranzbase has implemented reliable methods of encrypting all operations and storing customers’ personal and financial data.

3. Can I open an account remotely with Tranzbase?

Yes, Tranzbase enables users to open an Online Account, which does not take much time. It is fast and safe for users, and every user gets their specific IBAN in one to twenty-four hours.

4. Does Tranzbase offer currency exchange services?

Tranzbase is also known for offering its users the best and most economical forex rates so that they do not have to spend much on conversion charges. The platform also proves to be faster in processing other currencies, reducing risk.

5. What are the benefits of using Tranzbase for businesses?

On these platforms, businesses can enjoy features such as mass pay, a prepaid corporate card coupled with API integration for automation, adjustable pay limits, and cheap cross-border transactions.

6. How does Tranzbase reduce banking costs?

Since the company has no physical branches and transacts business online, it can charge minimal fees, which are actually some of its competitors, and offer better exchange rates.

Final Words

Exactly, Tranzbase strongly indicates the possibility of effectively competing with traditional banking systems by incorporating all the features of digital banking while satisfying all the necessary service requirements. It offers secure, fast, and cheap payment solutions that are considered to be most appropriate in today’s world of active financial management solutions.